Pharmac, Medical Insurance & access to treatment in NZ.

A quick guide by Scott Crocker

What is Pharmac?

Pharmac is a government agency in New Zealand that controls access to and funding of new medication. They make decisions about which drugs/treatments to support based on criteria such as clinical evidence, cost-effectiveness, and potential health benefits.

Why is this an issue for Kiwis?

Pharmac's funding decisions directly impact access to healthcare and prescription medications for millions of New Zealanders.

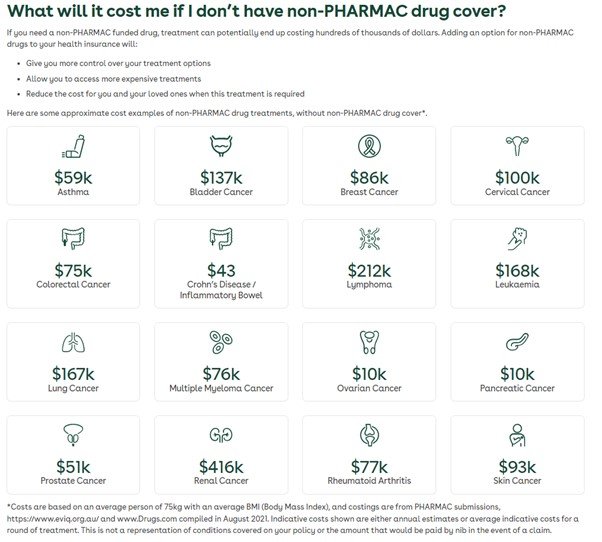

They subsidise 2000+ drugs and medical products, but budget constraints and high drug costs prevent funding of additional Medsafe-approved medicines for Kiwis. Meaning many drugs/treatments may not be covered.

What does this have to do with Medical Insurance?

Medical insurance policies vary in their coverage for non-Pharmac approved treatments. Some policies offer cover, others do not.

The amount of coverage offered by providers can vary significantly, we see contracts ranging from no coverage at all to as little as $10,000, and with more comprehensive policies offering $300,000 plus.

A quality and well-advised medical insurance policy should provide comprehensive levels of cover for non-Pharmac supported treatment to ensure you get the care you need. Having access to the best treatment has an enormous impact on overall well-being and can literally be a matter of life or death.

Real-life example:

Jen from the Bay of Plenty is an example of the potential consequences of an inadequate medical insurance policy. The mother of two’s stage 4 melanoma silently spread after she had a small mole removed 15 years ago.

Her best chance of survival is an immunotherapy drug called ipilimumab that Pharmac doesn't fund. She has medical insurance, but it doesn't provide cover for non-Pharmac funded drugs, leaving her and her family with a $100,000 bill… per annum.

Click here for the link to the story.

What can be done?

Review policy documents carefully and speak to our advisors to help you navigate the complexities of medical insurance, identify coverage gaps, and recommend solutions to ensure you have the protection you need.