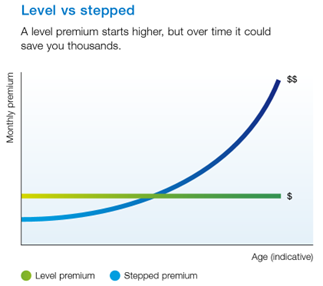

Finding the right fit: Level vs Stepped premiums

Level vs Stepped premiums - by Scott Crocker

When it comes to life insurance, there are two main premium structures:

Level premium: These lock in your premium payments long-term offering predictability and stability.

Stepped premium: Premiums start lower and increase as you age, reflecting the increased risk. Also known as Rate for Age (RFA).

Both premium structures can be suitable for different age groups depending on individual circumstances, financial situation and goals. Stepped premiums are often more suitable for younger policy holders or those who require large sums assured. Level premiums can provide greater stability and predictability in the long term.

Often the best solution is to combine a mixture of both premium structures. For example you could start with a stepped premium in the early years so that higher levels of cover can be accessed affordably. As time passes reviewing the sum assured on your policy and moving to a level premium will enable you to have peace of mind that your coverage costs will be sustainable long term and that your sum assured will meet your needs for many years to come.

Taking the time to make a plan and talk with your advisor about premium structure can save you thousands of dollars in the long run. A policyholder who switches from a stepped to a level premium at the age of 40 could save up to 30% on their premiums by the time they reach 60, and up to 40% by the time they are 80.

Understanding the differences between level and stepped premium structures is important to making informed decisions about your life insurance coverage. While a stepped premium structure may offer lower initial costs, a level premium structure can provide greater predictability and stability in the costs of coverage, and significant savings over time.

The key is to have a plan.