Specific Injury Cover

Specific Injury Cover - by Scott Crocker

What is Specific Injury Cover?

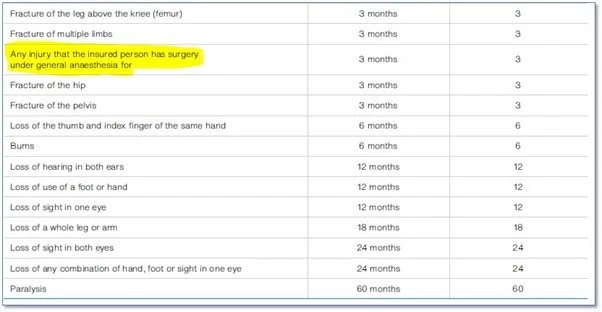

Specific Injury Cover provides you, your business, or your farm with an immediate lump sum payment if you suffer one of the specified injuries. The payment is calculated as a multiple of $5,000 (or the sum insured) depending on the severity of the injury (see table below) and it’s your choice how you use the money.

What problem does it solve?

If you suffer an injury because of an accident there are many situations where you will require immediate funds to protect yourself and your business. Any ACC benefit is paid after 7 days and the waiting period on Income Protection will likely be at least 4 weeks. A Specific Injury cover payment offers a supporting benefit to provide a cash injection which may act to replace lost income, hire replacement labour, hire a contract milker or use as you see fit.

Does this cover replace Income Protection?

Not quite. Specific Injury Cover acts as an affordable additional benefit to provide immediate financial assistance in the event of an injury. However, it does have the potential to fill the gap left during the waiting period between an ACC or Income Protection benefit payment.

Underwriting?

There is no medical or financial underwriting and no high risk or hazardous pursuits exclusions (e.g. stockcar racing or base jumping etc). This makes the cover extremely valuable for people with pre-existing conditions or high risk occupations who are unable to get Income Protection or Trauma Insurance.

Cost?

There are two premium classifications, a High Rate and a Low Rate based on the insured persons occupation (think blue collar & white collar).

These premiums start at $9.84 for high risk and $6.56 per month for low risk no matter your age, or health status.

How much will a claim pay?

Specific Injury Cover is paid based on the severity of your injury. Paying a multiple of your sum insured, usually $5,000. See the example below.

Example:

A person covered with Specific Injury Cover sum insured $5,000. The insurer will pay $5,000 multiplied by the severity of the event as defined in the table below.

Any injury that requires surgery under general anaesthesia (highlighted below) will receive 3 x $5,000 meaning a $15,000 lump sum payment to assist with unexpected costs.

Get in touch with Scott Crocker to discuss how Specific Injury Cover could benefit you.

*Note: All premium, underwriting and claimable condition information within this article has been disclosed with reference to the Specific Injury Support Benefit with a sum insured of $5,000 offered by Asteron Life, as of June 2022.